No, renewables don't need expensive backup power on today's grids

The actual story is the opposite: renewable energy pushes the most expensive fossil fuel plants out of business, lowering costs for consumers

“But what about when the sun doesn't shine?!”

Ah yes, the energy debate’s equivalent of “The Earth is flat!” Every time someone mentions solar or wind power, some self-proclaimed energy expert emerges from the woodwork to drop this supposedly devastating truth bomb: “Sure, renewables are cheap... until you need backup power for those cloudy, windless days. Factor in those costs, and suddenly fossil fuels are looking pretty sexy again!”

takes deep breath

Let me explain why this ironclad logic is as scientifically sound as claiming the Earth isn’t warming because it got cold last winter. Not only is the argument wrong — it's so fundamentally wrong that it reveals a complete misunderstanding of how modern power grids work.

Load vs. net load

Let’s start by imagining a grid that runs entirely on fossil fuels. As an example, here is the Electric Reliability Council of Texas (ERCOT) power load on Aug. 24, 2024:

On a fully fossil-fuel grid, fossil-fuel generators would continuously adjust their output to match total load, which rises in the morning as people wake up, increases through the day with air conditioning use, peaks in the early evening, and declines overnight.

Now, let’s look at how renewable energy changes this picture. On this day in 2024, renewable sources provided about 25% of the electricity load. But unlike fossil fuel plants that can adjust their output on command, renewable generation changes throughout the day with the availability of wind and sunlight.

This is where an important concept comes in: net load. Net load represents the amount of electricity that fossil fuel plants need to provide, and we calculate it by subtracting renewable energy production from the total electricity demand. For example, if at noon the total demand is 75 GW and solar panels are generating 25 GW, the net load would be 50 GW — that's what the fossil fuel plants need to supply.

The pattern of net load throughout the day is therefore shaped both by how much electricity people are using and how much renewable energy is available at any given moment. This combined pattern is what fossil fuel power plants must track and match with their generation.

The misleading “backup” claim

We can now see that the ‘backup power’ argument misses a crucial point about modern grid operations: flexibility is already baked into the system. When renewables enter the picture, the existing fossil fuel generator fleet shifts from following total load to following net load.

This transition actually improves grid economics by reducing the usage of the most expensive power plants. The result? Lower operating costs — without any need for new backup infrastructure.

In fact, as you add renewable energy to the grid, it pushes the most expensive generators off the generator stack, eventually causing them to run so few hours that they shut down.

So the story is exactly the opposite of what critics claim: rather than demanding expensive new backup systems, renewable energy actually pushes the most costly power plants into retirement, lowering the overall cost of operating the grid. This is how renewable energy helps reduce electricity costs for consumers.

What actually controls the cost of electricity on the Texas market?

Let me be clear: It’s not the amount of renewables. The graph below shows the ERCOT retail price of electricity (horizontal axis) and the percentage of electricity coming from renewable sources (wind plus solar, vertical axis), from 2010-2023. If the claim that “renewables make electricity more expensive” were true, we would expect to see prices rising with renewable percentage increases.

However, the data show no such relationship. If anything, the data suggest that, over most of this period, Texas maintained consistent electricity prices while adding huge amounts of renewables, demonstrating that the transition to renewable energy can be accomplished without burdening consumers with higher costs.

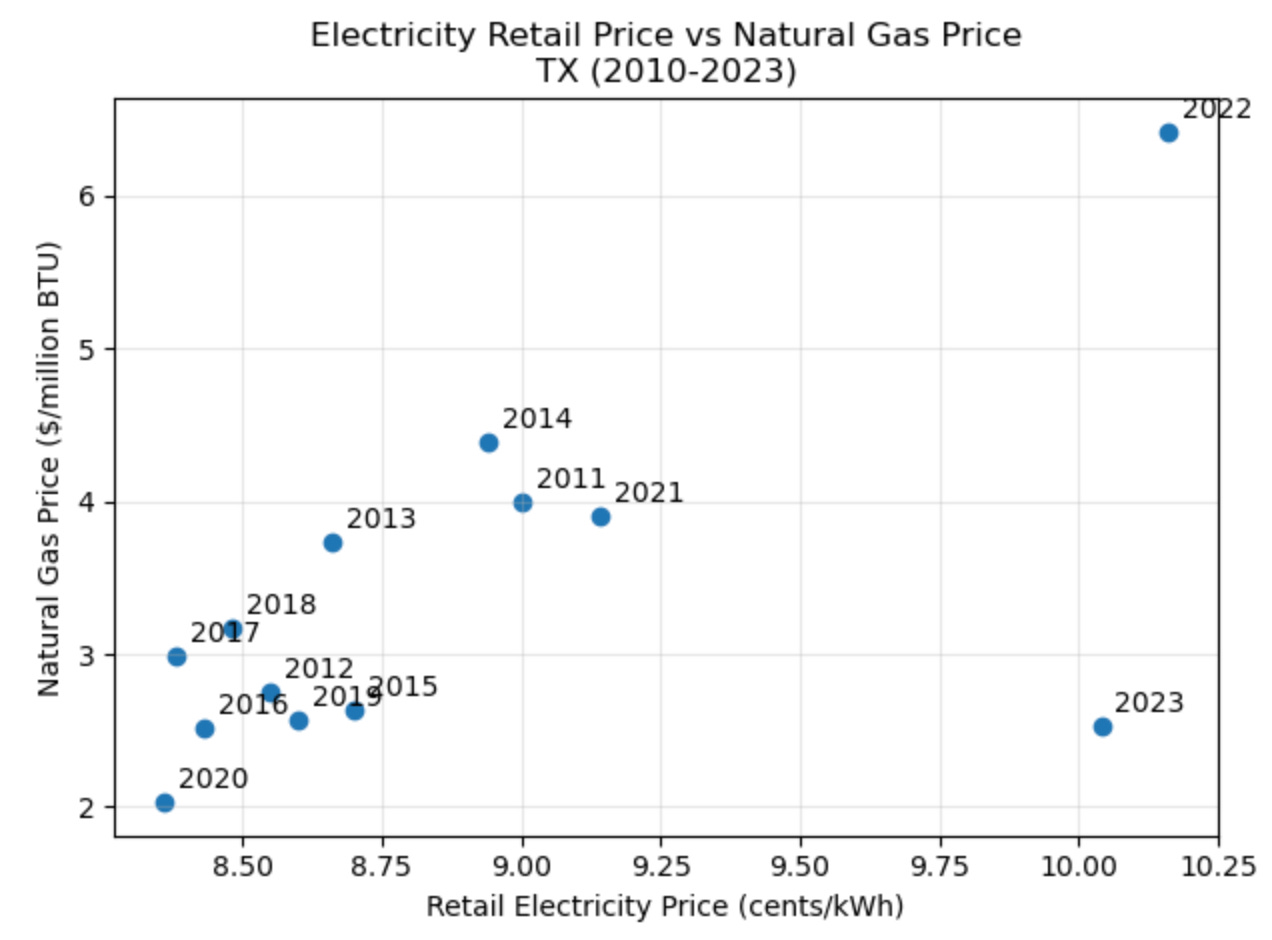

So what does control the price of electricity? Take a look at this plot:

This graph reveals that the price of natural gas is strongly correlated with the cost of electricity on the ERCOT market. This makes sense because natural gas power plants are almost always the marginal generators, thereby acting as the “price-setter” for wholesale electricity. This once again confirms that renewables are not increasing the cost of electricity in this market — it’s natural gas.

This comparison also emphasizes another benefit of renewables: it protects consumers from price volatility. Unlike natural gas, which has highly variable fuel costs that directly impact electricity prices, renewable energy has zero fuel costs once the infrastructure is built. Therefore, a market whose price is set by renewables will not see the large price fluctuations that we see in grids dominated by fossil fuels.

What’s the deal with 2023? The data point for 2023 shows how extreme weather can override normal ERCOT market dynamics. While natural gas prices had fallen significantly from its 2022 peak, annual average electricity prices in Texas remained elevated due to an unprecedented heat wave in summer 2023 that strained the grid to its limits.

During those extreme conditions and the very high demand that accompanies it, ERCOT implemented scarcity pricing — a market mechanism that allows electricity prices to rise dramatically when demand approaches the grid’s capacity. The high prices are supposed to encourage large consumers to reduce their power usage and helps prevent blackouts. As a result, even though natural gas was relatively cheap, retail electricity prices stayed high because of this artificial scarcity signal.

Thus, renwable energy is presently saving the economy money by pushing expensive fossil fuel generators out of the market. Full stop.

Note that this discussion applies to today’s grids, which are mostly powered by fossil fuels (e.g., Texas is 30% renewable, with fossil fuels making up about most of the rest). As grids approach 100% renewable energy, the economics and requirements of the grid changes. I will talk about that in a future post.

More things to read

My last post described how many electricity markets work and why renewables should reduce costs.

Hannah Ritchie has written some really good posts about how renewable energy affects energy costs, like this recent one. She also has a great article on why natural gas sets the price of electricity in the UK. You should definitely subscribe to her substack.

Sorry, Andrew, but if that were true, why on earth would PG&E be spending millions and millions of dollars on batteries? And why would California be suffering brownouts and blackouts?

Here's perplexity on the subject … in total and complete contradiction to your false claims, utilities worldwide are adding peaker plants.

w.

===

Several utilities in the United States have added fossil fuel backup to renewable electricity systems to address high energy demand and grid reliability concerns. Here are some examples:

1. **Georgia Power**: The utility has proposed adding three new fossil fuel turbines powered by oil and natural gas to meet rising electricity demand. While their plan includes solar power with battery storage, it relies heavily on fossil fuels for peak demand periods, citing reliability concerns[1].

2. **California**: Despite being a leader in renewable energy adoption, California has kept gas plants operational and delayed the shutdown of the Diablo Canyon nuclear plant due to grid instability and blackouts caused by the intermittency of renewables. Wealthier residents and businesses have also resorted to diesel generators as backups[4].

3. **General Trend Across Utilities**: Many utilities across the U.S. are turning to "peaker plants," which are fossil fuel plants designed to operate during peak demand hours. These plants provide quick, dispatchable power when renewable energy sources like wind and solar are insufficient due to weather or time of day[1][8].

While alternatives like large-scale batteries, virtual power plants, and demand response programs exist, many utilities continue to rely on fossil fuels for their perceived reliability and ease of use during peak demand periods[1][6][8].

Citations:

[1] https://grist.org/energy/high-power-demand-utilities-see-fossil-fuels-solution/

[2] https://www.greentechmedia.com/articles/read/as-fossil-fuel-pipelines-fall-to-opposition-can-clean-energy-replace-them

[3] https://www.wri.org/insights/setting-record-straight-about-renewable-energy

[4] https://democracyjournal.org/arguments/why-renewables-cannot-replace-fossil-fuels/

[5] https://www.pnnl.gov/explainer-articles/renewable-integration

[6] https://www.washingtonpost.com/climate-solutions/interactive/2024/flow-batteries-renewable-energy-storage/

[7] https://www.iwf.org/2021/11/08/renewable-energy-needs-fossil-fuel-as-a-backup/

[8] https://theconversation.com/utilities-rely-on-dirty-peaker-plants-when-power-demand-surges-but-there-are-alternatives-231232

---

Answer from Perplexity: pplx.ai/share

I would argue that your example does not show that renewables do not need backup. It shows that if you already have enough fossil fuel sources to cover any demand, you can add wind/solar at low cost. That’s not the same thing. If you want to increase the capacity of your system, then any wind/solar you add MUST have backup. That might be importing, or it might be batteries, but it has to be something.