Expanding liquefied natural gas: A bad, short-sighted strategy

it undermines the world's climate and U.S. economic security

The Biden administration's decision to delay the approval of the largest natural gas export terminal in the U.S. is a critical juncture in global climate policy. This postponement, affecting possibly 17 proposed terminals, reflects concern about the long-term impact of liquefied natural gas (LNG) expansion on climate change, the economy, and national security.

The short-term appeal of LNG expansion

Generating energy from natural gas produces around half the carbon dioxide that energy from coal produces. Thus, displacing coal with natural gas does reduce emissions of carbon dioxide.

This coal-for-gas substitution has been occurring in the U.S. for the last 20 years and is a primary reason for the decline in U.S. emissions over that period.

Thus, in the near future, expanding LNG exports could reduce emissions, as long as it caused emitters to switch from coal to natural gas and upstream methane leakage is kept low — both big ‘ifs’.

The long-term damage of LNG expansion

But most scenarios for achieving the Paris Agreement’s target of “well below 2°C” have global coal use dropping to near zero in the next 15 years. The LNG infrastructure being proposed, however, will have a lifetime of 50-100 years. This means that building this infrastructure locks us into emissions extending well beyond the expected shutdown date of most coal plants.

Thus, considering the full lifespan of the infrastructure, these LNG plants will lead to higher emissions. This makes it increasingly difficult to meet the Paris Agreement goals. Perhaps we can just build the LNG infrastructure now and shut it down in 2040, when we phase coal out. That seems unlikely — once billions are invested in new pipelines, export terminals, and import facilities, the political pressure to keep operating them will be enormous.

If we want to avoid being saddled with unnecessary emissions after coal is phased out in a few decades, the time to take action is now.

If you’re interested in a much more detailed analysis about this, read this paper.

Bad for U.S. consumers

Prior to 2016, LNG was not exported from the U.S., and domestic natural gas production basically served only the local market, keeping prices relatively low1.

With the shift towards exportation, U.S. consumers must now pay the global price for natural gas. This is a consequence of the fact that producers want to sell gas for as high a price as possible: if the price in Europe is $3/MMBTU, they’re not going to sell it to U.S. consumers for less than that. Rather, they’ll export it to where it can fetch the highest price.

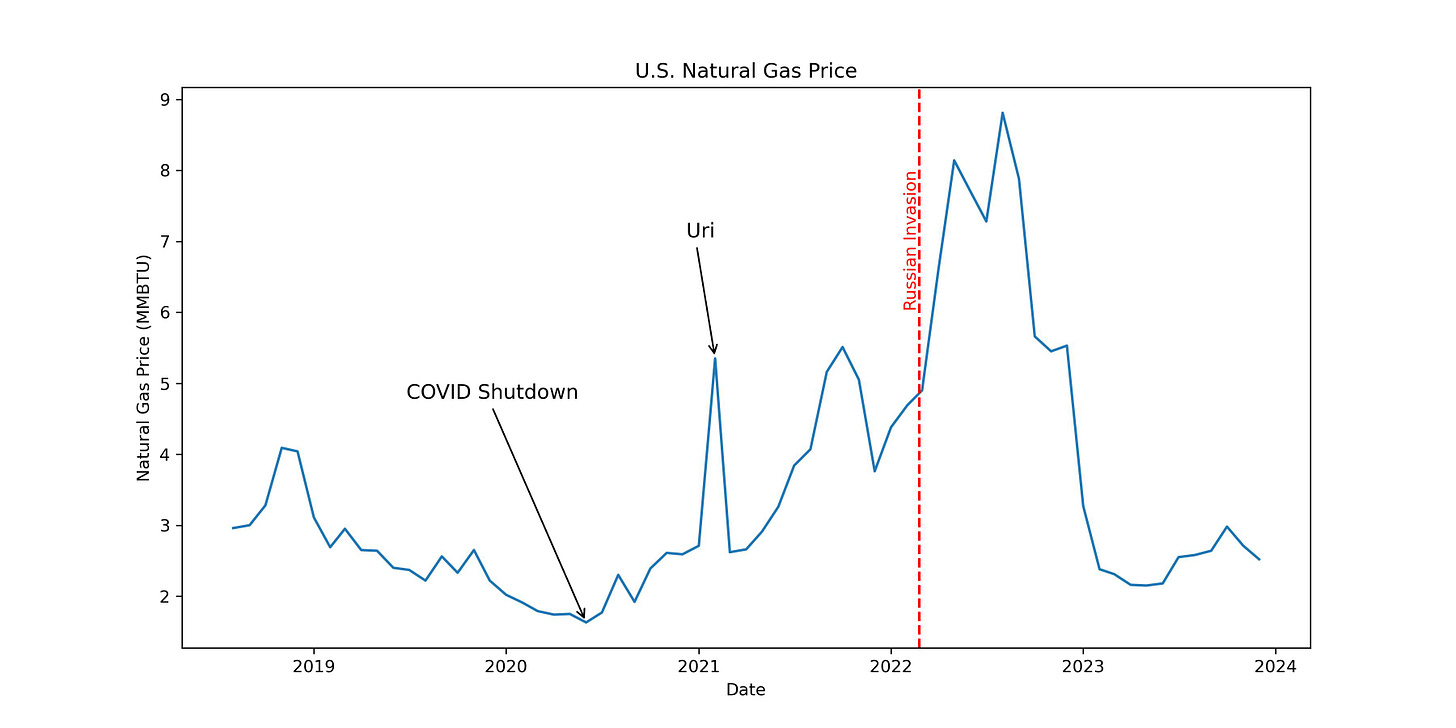

This in turn exposes U.S. consumers to international political turmoil. For instance, the Russian invasion of Ukraine spiked the price of natural gas in Europe and, because of LNG exports, those price increases rippled into the U.S. market, as this plot shows:

So when you hear something like this, from the NY Times article linked above:

“This move would amount to a functional ban on new LNG export permits,” Senator Mitch McConnell of Kentucky, the Republican leader, said on the Senate floor Wednesday. “The administration’s war on affordable domestic energy has been bad news for American workers and consumers alike.”

Realize that the exact opposite is true. Adding export capacity will, if anything, raise prices for U.S. consumers because they will now be more efficiently competing with consumers in other regions (e.g., Europe and Asia).

Bad for energy security & democracy

This fact that the Russian invasion of Ukraine raised prices for U.S. consumers, despite the U.S. producing far more gas than we consume, illustrates a crucial point: energy security cannot be achieved solely through increased fossil fuel production.

We can drill, drill, drill, but for both oil and gas, which are priced globally, bad actors like Russia or Saudi Arabia can still raise the price U.S. consumers pay by, for example, raising the price Europeans are paying.

Thus, when the U.S. exports LNG, it hands dangerous leverage to authoritarian regimes. The Kremlin can weaponize this by throttling supplies, spiking prices, and plunging U.S. families into cold and darkness. They'll use this to further divide our society, undermine faith in democracy, and advance their anti-Western agenda.

As long as oil and natural gas are priced globally, there’s nothing the U.S. can do about this2. In fact, the only path to energy security is through renewable energy. Saudi Arabia can’t change the cost of solar energy, nor can Russia cause the wind to stop blowing. Luckily, the cost of transitioning to safe and reliable renewable energy is small.

Conclusion

The iron rule of climate policy should be: do not build more long-lived fossil fuel infrastructure because, once you build it, the pressure to keep using it will be immense. As of 2019, the stock of fossil fuel infrastructure was still consistent with the Paris Agreement, but that will not remain true if we continue building more.

The refrain “drill, baby, drill” is a false promise of energy security. In truth, building more LNG infrastructure hands hostile foreign powers a loaded gun to hold to our economy’s head. Bad actors can pull the trigger and send global prices skyrocketing, in turn raising prices for U.S. consumers and causing our economy great pain.

There is no fossil-fuel powered path to energy freedom. True energy independence can only be achieved by unshackling ourselves from all fossil fuels — foreign and domestic — through a transition to renewable energy.

Unrelated stuff you might be interested in

Andy’s podcast with the Richmond Times-Dispatch about the ridiculous warmth of 2023

Andy also had an oped in the San Antonio Express-News about 2023; the editorial board weighed in their own take here.

Pre-2016, some natural gas was exported via pipeline to Canada and Mexico.

The one tool the U.S. does have is the strategic petroleum reserve, but I’ll save that for another post.

Howarth and McKibben are spot on. We have much better solutions. This is the business of fossil fuels trying to twist the nose of leadership, again. Save money while saving the planet and blow them and their unsupportable hogwash excuses to delay their demise. Do your homework, and it is obvious. The administration sees it now. Moving on... all the way now to faster ROI and smart power. Free from the sun in short order. Please don’t buy into this pitch to more unsustainable atmospheric and oceanic harm.

Here's what I think.

1. I think pausing is the right thing to do.

2. I think that there is enough information out there to make a decision and that Congress should demand that DOE give them a recommendation in 1 to 2 months.

3. I think the answer depends on how much coal the LNG displaces, https://thebreakthrough.org/issues/energy/howarth-natural-gas. If I understand Zeke's analysis correctly, basically LNG beats coal regardless of assumed reasonable leaks rates for methane in terms of long term warming potential or forcing function.

4. Believing that we are going to drive global coal use to zero in 15 years is not realistic. We will be lucky to drive coal to zero in the U.S. in 15 years.

5. I don't think Howarth and McKibben should be driving the bus.