Climate change and insurance: The alarm bell we can't afford to ignore

Insurance markets are the canary in the coal mine

While the world's attention is often drawn to potential tipping points within the physical climate system, such as the rapid disintegration of ice sheets, changes in the carbon cycle, or a sudden slowdown of the ocean circulation, there’s also a pressing need to recognize that climate change can also trigger tipping points within our economic systems.

In fact, we may be far closer to socio-economic tipping points than we are to physical tipping points. A prime example comes from the insurance market. Insurance companies are pulling out of regions most susceptible to the impacts of climate change, including California, Florida, and Louisiana.

The insurance companies that are moving away from these places aren’t bleeding-heart environmentalists; these are hard-nosed businesses. They’ve crunched the numbers and concluded that the increasing frequency and intensity of extreme weather events—driven by climate change—have made some places effectively uninsurable.

The risk landscape is changing, and insurers are sounding the alarm.

Insurance is a pillar of our economy

This is very bad news because insurance is a cornerstone of our modern economy. For example, the American dream, buying a house, often requires the buyers to obtain homeowners insurance before they can get a mortgage.

But as climate change drives increases in risks and insurance companies become unable to charge large enough premiums to cover the risk, insurers are becoming increasingly reluctant to write homeowners policies in vulnerable areas.

As insurance gets more expensive and harder to get, property values will begin to decline. This, in turn, erodes the property tax base that local governments rely on to fund essential public services like schools and emergency response. As services degrade, even more residents may leave, amplifying the decline in property values. Eventually, banks, gas stations, and grocery stores leave and the only residents remaining will be those too poor to leave.

The end result of this feedback loop is a deeply entrenched economic crisis that could affect us all. Everyone will be affected, even if your house is not particularly vulnerable to climate impacts.

States, underpricing, and the road to ruin

As insurance companies leave the market, it is inevitable that states will step in and become the insurer of last resort — the place you go when no one else will insure you. Florida’s state insurer, Citizens Property Insurance Corporation, is now the largest and fastest-growing insurer in the state.

But this just transfers the problems of private insurance to the citizens of the state. The public insurer still has the problem that it needs to charge high premiums to cover the risk of damage. In Florida, for example:

Citizens makes money through rates and premiums, and this month, the group requested the “maximum rate increase allowed,” with the average cost to customers expected to rise by as much as 12%.

Michael Peltier, Citizens’ media relations manager, said that, at the moment, the company has enough financial cushion to absorb the new policies, assuming the rate increase is approved. But if enrollment growth continues, Peltier said Citizens may be forced to levy additional assessments not just on its own policyholders but also anyone with any kind of insurance in Florida, including auto.

“It's not a healthy environment,” Peltier said. “This growth we have is not sustainable.”

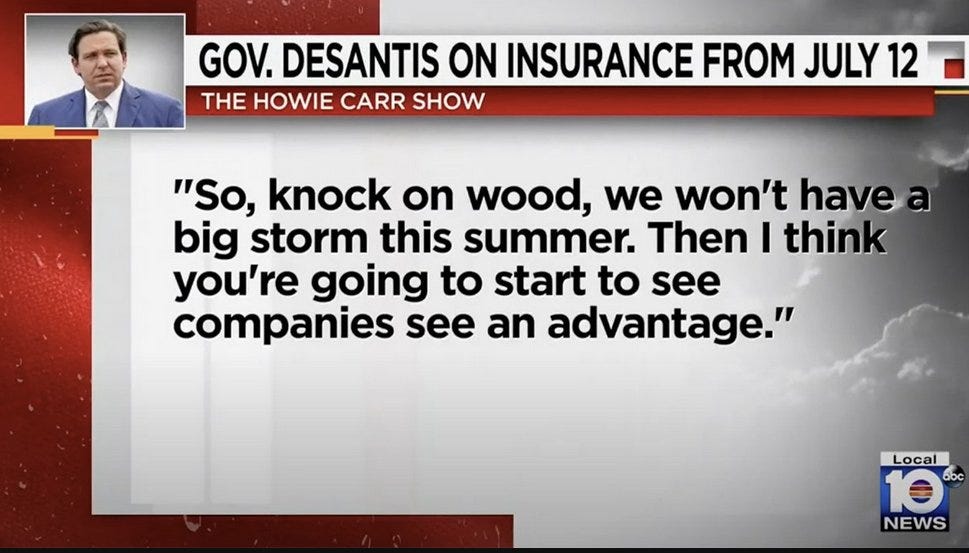

Eventually, States may be unable to charge enough to cover the risk without tanking the real estate market. They may try to avoid that problem by charging too low a premium and just rolling the dice and hoping that a big event doesn’t occur.

If a “once-in-a-century” storm hits (which seems to happen every few years), states would be financially overwhelmed. The federal government might bail them out once, maybe twice. But eventually, public sentiment will turn. And here’s where the grimmest future comes into focus: failed, bankrupt states and a torrent of people migrating from them. It’s not a pretty picture.

The Takeaway

So, what should we take from all this? Insurance companies, by their very nature, are in the business of evaluating risk. Their retreat from high-risk regions is a business decision for them, but to us it’s an undeniable indicator of the looming threats posed by climate change. A malfunctioning or non-existent insurance market will have ripple effects, destabilizing housing markets, undermining economies, and disrupting societal structures.

The insurance companies are ringing the alarm bells — it’s high time to heed their warnings.

Related posts

There may also be the risk that with shrinking property values, the value of collateral on banks' balance sheets (heavily residential and commercial real estate via mortgages) also shrink, creating systemic challenges in the banking sector.

Well said. Nobody pays much attention until it hits one's pocketbook. Without a cover of insurance for our poor decisions on building in flood and fire prone areas and on denial of climate change predictions, the reality of real personal loss rears its monstrous head. The exit of private insurance companies and the personal financial pain it will cause might be the two-by-four whack in the forehead we have needed for decades now to focus our collective attention. Without insurance, the mortage loan industry exits as well toppling all the other dominoes in the chain.