About two weeks ago, I filmed a PBS television show, set to air in October, about energy and climate policy. A lot of my disagreement with the other guest revolved around a particular question: Is renewable energy (RE) cheaper than fossil fuels?

To begin to answer this, we need to define what cost we’re talking about. Let’s first talk about the cost of RE energy vs. fossil-fuel energy on a grid that’s dominated by dispatchable power, such as fossil fuels. This is what most electrical grids are like today.

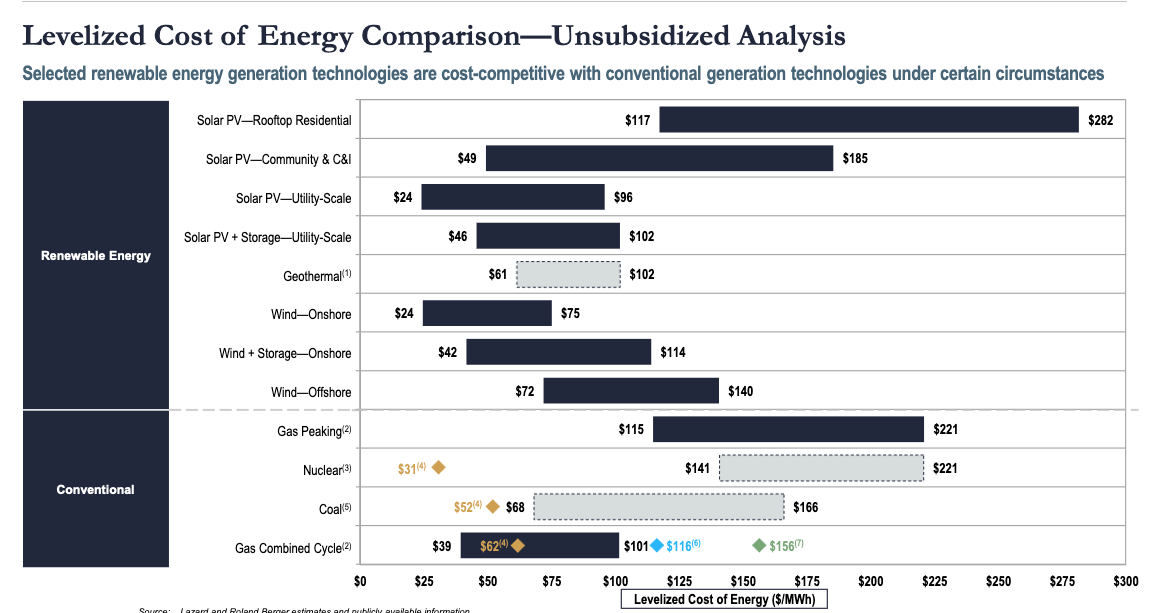

For a grid dominated by dispatchable1 power, the intermittency of wind and solar imposes no costs. Thus, the relevant cost comparison is between the so-called Levelized Cost of Energy (LCOE) of the various energy sources:

Virtually all credible analyses agree that RE has the lowest LCOE. Therefore, it is the cheapest energy source for grids that contain a lot of dispatchable power.

This explains why, for example, 95% of the power scheduled to be hooked up to the ERCOT grid is RE (solar, wind, or batteries). Natural gas is 5%.

Diminishing returns

For a grid that’s mainly fossil fuels, every kW of renewable power (RE) you add displaces a kW of expensive and dirty fossil fuel power. But, as the grid gets more and more RE, that changes. At high levels of RE deployment, the intermittency of the wind and solar means that you need to add several kW of wind and solar to displace a single kW of fossil fuels. This drives up the marginal cost of RE energy.

In addition, high RE levels mean that RE is competing with the most efficient and cheap fossil-fuel generation, some of which have not yet been paid off. Additionally, the more RE you add, remaining RE sites are higher cost and lower quality.

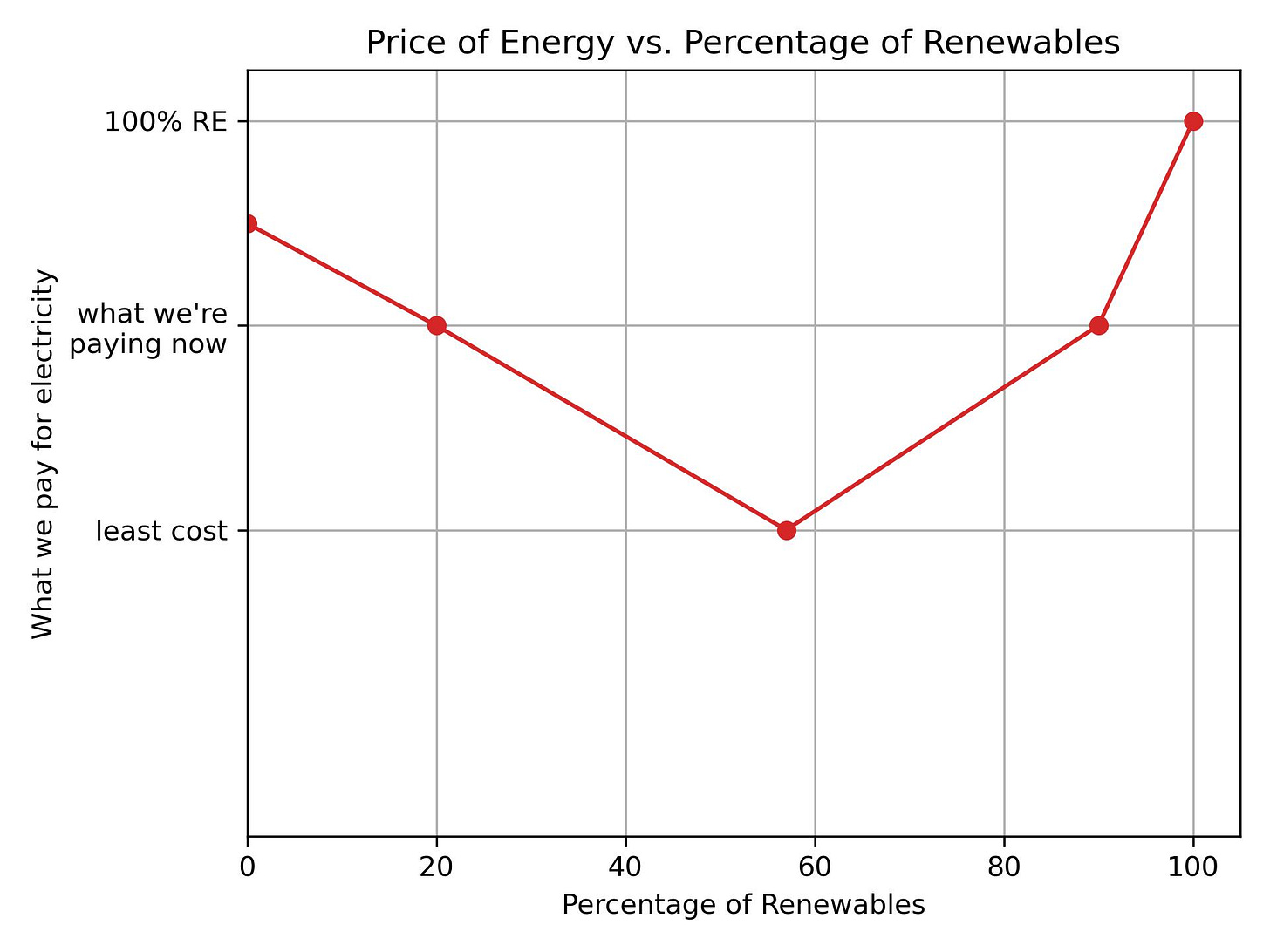

The net result is that, beyond some point, the price of energy on the grid starts increasing as you add RE. Qualitatively, the price of electricity vs. RE deployment looks like this:

Right now, around 20% of our electricity comes from wind and solar and this is already saving consumers billions of dollars a year. As we increase RE deployment, the price of electricity will continue to decline and consumers save money.

Then we reach the minimum price point. One study from NREL concluded that this occurs when RE penetration reaches 57% (in 2050). At this point, electricity produced on this grid is cheaper than a fossil-fuel heavy grid and, as a bonus, we’re also emitting a lot less CO2.

Let me repeat for those in the backrow: getting to a 57% renewable energy saves us money and reduces CO2 emissions.

As we move beyond 57%, the declining value of wind and solar to the grid means the price of energy increases. However, it remains below what we’re paying today for a fossil fuel grid until we get to around 90% RE.

Let me repeat for those in the backrow: we can get to a 90% RE grid and pay about the same as we’d pay with a fossil-fuel heavy grid. And this doesn’t account for the external costs of fossil fuels (see below).

The costs of net zero

A significant amount of the discourse about RE focuses on the cost of achieving net zero by 2050, which requires completely eliminating fossil fuels. No one knows how much this will cost, but some studies have produced eye-popping numbers:

Many analyses have looked at this goal and they agree that a lot of the costs of reaching net zero are driven by the cost of phasing out the last few percent of fossil fuels. The reason is that the last few percent of emissions are the hardest to abate and the ones for which technology to replace fossil fuels is expensive or undeveloped. For example, decarbonizing long-distance airline flights is one of the last things we’ll decarbonize because it would probably require biofuels, which could have very high costs.

This is quantified in this plot, which shows the incremental abatement cost (orange line) as a function of how much RE is on the grid. For a 95%-RE grid, the abatement cost is $200/tonne, increasing to $930/tonne for 100% RE.

Thus, it’s easy to look at the price tag for getting to net zero and conclude, “Wow, this is too expensive.” But that misses the fact that the cost of getting to a slightly lower value, e.g., a 90% clean-energy grid, is actually quite modest.

These net-zero estimates also hinge heavily on future innovation — a variable notoriously difficult to predict. History has shown us, particularly in the last decade, that technological advancements can drastically outpace predictions, as seen with the enormous drop in the cost of solar panels, which no one predicted.

External costs

All of these discussions focus on the market price of energy. Such a discussion neglects the extensive subsidies that distort the energy market. While RE sources receive financial support, the subsidies for fossil fuels are substantially larger and more ingrained within global economies.

Moreover, the price of fossil fuels seldom reflects their full societal costs — what economists call externalities. Recent estimates of the cost of climate impacts puts it around $185/ton of CO2 emitted. These costs are not included in the cost of fossil fuels.

Air pollution from fossil fuels kills millions of people every year. Like the climate impacts, the costs of this are not included in the price. Fossil fuels have also been linked to significant political and social instability. For instance, the U.S. invaded the Middle East twice in the last 35 years in order to stabilize the oil supply. The Russian invasion of Ukraine is intimately tied to fossil fuels. These costs are also not included in the costs of fossil fuels.

If we added these externalized costs to the cost of fossil fuels, the argument increasingly tilts in favor of RE.

Summary

In any complex discussion, you need to carefully define the question you’re asking. Much of the discussion around renewable energy focuses on net zero, because that’s what we ultimately need to aim for. We really don’t know how much achieving net zero by 2050 will cost because it will depend to a large extent on future innovation.

But a large chunk of the cost of net zero is driven by the last few percent of decarbonization. If you talk about, say, a 90% clean grid, the cost of achieving that using today’s technology is approximately zero. And this cost comparison excludes the external costs of fossil fuels: climate impacts, air pollution, geopolitical instability. Taking all factors of those into account, there’s no question that we can largely decarbonize today and end up with a better economy and cleaner environment.

Related resources:

Princeton Net Zero America Project

Dispatchable power can be turned on/off at will.

Nicely done. One of your best. I guess we have to wait to see who the other guest is.

A couple related items have come across my radar over the last few days. One was the SHIFTKEY podcast with Jesse Jenkins on the relative benefits of rooftop solar, https://heatmap.news/podcast/shift-key-episode-five-rooftop-solar , "Does Rooftop Solar Actually Help the Climate?" The answer basically is that it depends and he argues that in most cases it just displaces other less expensive solar, i.e. utility solar. I'm not sure I agree but you hardly ever want to challenge Jesse on such an issue. I put solar on my house 4 years ago and in the meantime my utility has had trouble adding solar because of supply issues. In my mind, a clean kWh today beats a clean kWh tomorrow. I think he concedes my point in the broadcast but in the end the listener is left questioning the value of rooftop solar which seems counterintuitive.

The other thing that I saw that I want to give a shout out for is the analysis at Carbon Brief that talks about the effect of electing Trump on carbon emissions, https://www.carbonbrief.org/analysis-trump-election-win-could-add-4bn-tonnes-to-us-emissions-by-2030/ . We need to be reminding people, especially younger voters, that we cannot afford to go backwards on climate change.

Aren't most of these prices an illusion, even in the middle term? I think it's good to encourage people to see that the first stage of the energy transition is 'affordable' in our daily context, but the reality is, emissions are an existential problem that has to be solved, or at least ameliorated, even for the super wealthy with their ideas of digging a bunker in case of societal breakdown. If your house is on fire with all your money in it, counting the money while things are burning (including money) is a maladaptive response.

Bunkers are a good comparison on price, because obviously for some of us (ahem, Mark Zuckerberg), the price is right for a bunker. Interestingly, the price is still wrong for Zuckerberg to turn Facebook into a giant climate education and social contract generating machine.

Inferred by that logic, with super-wealth, there is no price worth the constraints of a functioning democracy. Life in a bunker is better than democracy.

Sidenote: if you really were in a bunker, any of the prices that seem familiar to us today are already out the window (or hatch, I guess). Do you have a dentist in your bunker?

There is also a middle term crisis that dwarfs prices as we know them: what happens if 100 million climate migrants try to enter the US over a 10 - 20 year period? That number could be on the low side judging by this paper:

https://www.pnas.org/doi/pdf/10.1073/pnas.1910114117

Meanwhile, the US will be experiencing internal migration.

https://us.macmillan.com/books/9780374171735/onthemove

My guess is that if anything pushes us to spraying sulfate aerosols in the stratosphere, it will be the existential necessity of trying to keep a billion people in their own regions, after having bungled our concept of pricing in every decade prior.